100+ MORE

- We never sell your information — we can earn money by helping you find insurance

- We don’t pick favorites — our content is written and reviewed by an independent team of editors and licensed agents.

Table of contents

Why Compare Florida Insurance Rates with Simplfii

Simplfii connects Florida drivers with multiple top-rated insurance companies at once, making it easy to compare real-time quotes and coverage options. Rates are transparent, unbiased, and based on your actual driving profile — not estimates.

Most drivers can compare quotes in under 3 minutes and see immediate savings opportunities.

With Simplfii, Florida drivers can compare rates from top insurance companies in minutes — without spam, pressure, or hidden markups.

- Fast auto insurance quotes in 2 minutes

- Real-time Florida car insurance rates powered by AI

- Transparent pricing with no hidden fees

- Compare 50+ top insurance companies

- Save up to $1000 on Florida car insurance

- Instant discounts based on your car, driving habits, and location

- Simplfii has been used by over 2 million drivers nationwide to save money

How Florida Drivers Save on Auto Insurance

Compare Real-Time Quotes

The fastest way to find affordable Florida car insurance is by comparing real-time quotes from multiple carriers in one place. Platforms that gather quotes instantly help you see all available options and pricing side by side so you can choose the best coverage for your needs.

Choose the Right Coverage Levels

Opting for only the required minimum may lower your premium, but having adequate coverage can protect you from high out-of-pocket costs after a serious accident. Drivers with higher limits often avoid financial strain from lawsuits or expensive medical bills.

Discounts & Bundling

Many insurers offer discounts for things like:

- Safe driving records

- Multiple policies (e.g., bundling auto with home insurance)

- Vehicle safety features

Always check which discounts you qualify for to lower your premiums.

Shop Smart & Review Annually

Insurance rates can change each year. Reviewing your policy and comparing rates annually ensures you’re not overpaying and helps you take advantage of new savings opportunities.

Florida Auto Insurance Requirements

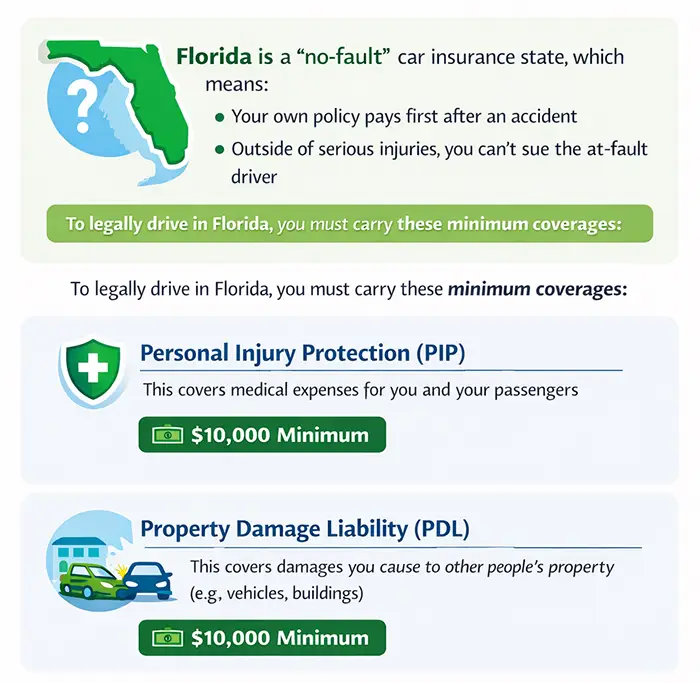

Florida is a no-fault insurance state, which means your own policy pays first after an accident. To legally drive in Florida, the state requires:

| Coverage Type | Minimum Amount |

|---|---|

| Personal Injury Protection (PIP) | $10,000 |

| Property Damage Liability (PDL) | $10,000 |

* Coverage minimums shown are based on standard requirements and may vary by insurer or policy. Contact your provider for up-to-date details.

** PIP covers medical expenses regardless of fault; PDL covers damage to other vehicles/property.

** These minimums meet legal requirements, but many drivers choose higher limits to protect against medical costs, lawsuits, and uninsured drivers.

Average Florida Car Insurance Rates

Auto insurance costs in Florida vary significantly based on coverage and driver profile. Below are typical monthly rate ranges when you compare Florida insurance rates across multiple carriers.

Florida Car Insurance Savings Summary

| Savings Method | Potential Annual Savings |

|---|---|

| Comparing Multiple Quotes | $500 – $1,000 |

| Switching Insurers | $400 – $900 |

| Bundling Auto + Home | $250 – $600 |

| Safe Driver Discounts | $150 – $400 |

Drivers who compare quotes often find savings of $500–$1,000 per year by switching insurers or adjusting coverage.

What is the minimum car insurance required in Florida?

Florida car insurance rates are high due to frequent accidents, severe weather, insurance fraud, uninsured drivers, and high litigation costs. Because rates vary widely by insurer, comparing Florida auto insurance quotes can significantly reduce your premium.

Why is car insurance so expensive in Florida?

Florida car insurance rates are high due to frequent accidents, severe weather, insurance fraud, uninsured drivers, and high litigation costs. Because rates vary widely by insurer, comparing Florida auto insurance quotes can significantly reduce your premium.

Is Florida a no-fault insurance state?

Yes. Florida is a no-fault state, meaning your own PIP coverage pays for medical expenses after an accident regardless of who caused it. This allows claims to be processed faster but does not eliminate the need for additional coverage.

What is the cheapest car insurance in Florida?

The cheapest car insurance in Florida depends on your location, driving record, vehicle, and coverage level. No single company is cheapest for everyone, which is why comparing Florida insurance rates across multiple insurers is the best way to find the lowest price.

How often should I compare Florida auto insurance quotes?

It’s recommended to compare quotes at least once a year or anytime your circumstances change, such as moving, buying a new car, or experiencing a change in driving record. Rates change frequently, and loyalty does not always guarantee the lowest price.

Does comparing car insurance quotes affect my credit score?

No. Comparing Florida auto insurance quotes does not impact your credit score. Quote comparisons use soft inquiries or underwriting data that do not affect your credit profile.

Can I switch car insurance companies at any time in Florida?

Yes. Florida drivers can switch insurers at any time. Many drivers switch mid-policy to secure lower rates or better coverage, often receiving a refund for unused premiums from their previous insurer.